Last Updated on April 17, 2024 by Ben

Goldbroker is one of the most reputable and popular on the internet. They have been in business since 2011. They have been around longer than many other gold brokers out there. The company specializes in buying and selling gold, silver, platinum, and palladium bars and coins and offering safe international storage options for its customers.

Pros

- They offer storage of precious metals in four countries.

- No custodians in the middle of you and your gold

- Signing up is easy and secure

- You can take delivery of your precious metals with ease.

- Owners visit the vault at any time without a company representative.

Cons

- Pricing for commissions on purchases is not transparent.

- Storage fees vary depending on the number of gold bars you invest in

- Their selection of coins is mostly limited to large quantity orders

- They don’t offer a lot of platinum or palladium products.

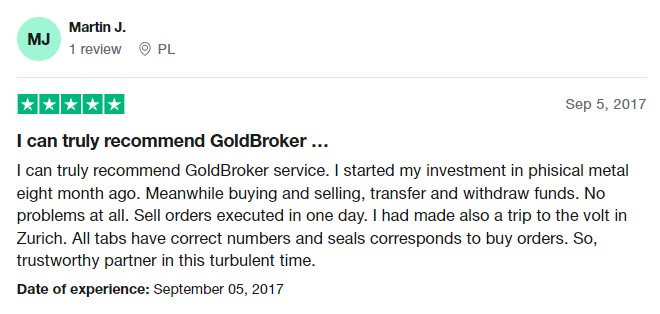

Reviews and Testimonials

What is GoldBroker About?

GoldBroker’s international storage is a standout strength for those with IRA accounts. The only downside to these offerings is the larger quantities of 10 gold coins and 500 silver coins, which may not be ideal for investors that are looking at smaller investments.

Company History

GoldBroker is a mysterious company at first glance. Who would have thought that this organization’s name holds so many secrets? Finding their information can be pretty tricky unless you know to look under the umbrella term of their parent company, FDR Capital. They basically act as custodians for gold and other precious metals; they sell them in bars or coins. They maintain offices all over, including New York City and Malta (their headquarters).

They provide secure allocated storage for precious metals around the world. Armed with cutting-edge technology, they help investors quickly buy and store physical gold or silver bars securely in Switzerland, Canada, or Singapore – out of reach from the traditional banking system, where it is most vulnerable to fraud. Their corporate vision revolves around helping holders of precious metals do this more effectively without having to worry about what’s happening onshore.

The company’s online platform is easy to use, offering investors a simple way of buying gold and silver bullion bars. They also have an in-house program where they buy back precious metals from their clients with full ownership maintained by the purchaser at all times. They allow the owners of these assets to keep them in their own name with full ownership of all holdings involved without involving any intermediaries.

When you sign up for an account, you must first purchase at least $5,000 worth of gold or silver. They offer one-ounce bars of both gold and palladium and 10-ounce bullion ingots composed of 1-ounce bar-shaped blocks. You can also buy single coins in quantity, starting with 450 – 500 ounces of silver.

Management Team

Two people run GoldBroker. These experts have been investing for many years. Fabrice Drouin Ristor, CEO and fund manager of both GoldBroker and their parent company FDR Capital, has been managing precious metals since 2008.

Egon von Greyerz is one of the biggest names in Swiss banking. He started on FDR Capital’s board back in 2012 and founded internationally respected German company Matterhorn Asset Management AG as well as GoldSwitzerland, a gold broker based out of Switzerland that offers storage services for investors all over Europe.

He worked for a company called Dixons. He was the finance director and then vice-chairman. He did well with mergers and acquisitions, so he then went on to start his own company called Matterhorn Asset Management. His new business was successful because it could help people maintain their wealth through different asset allocation skills.

The man has spoken at investment conferences around the globe. He’s also written numerous articles on precious metals, the global economy, and preservation of wealth strategies that give him a great deal of credibility when he speaks about these topics to investors in FDR Capital or gold broker, where his presence lends name recognition.

What GoldBroker.com Offers to Gold Investors

Investors can buy gold or silver from the company. They store the gold in vaults in Zurich, Singapore, Toronto, or New York. It also offers people investments in these metals starting at $5,000.

This company is the place to go for all your precious metal needs. Gold, silver, platinum, and palladium are just a few of their many products on offer. They also buy back any product you might have purchased from them in order to ensure satisfaction with both orders placed by customers as well as reviews listed online. Simply visit Goldbroker.com and read through some of these eye-opening, honest opinions about this company’s work ethic.

Products

Gold and silver bars, as well as some platinum and palladium, are sold at the GoldBroker. Most of the products they sell come in large quantities. This could be a 10-ounce roll of gold coins or 450-500 monster boxes of silver coins.

Recently, they have begun to offer coins and smaller gold, platinum, and palladium bars. You can buy the big gold or silver bars from 15 ounces to 1,000 ounces. They will buy back any of the products which they sell if you contact them and talk about how much you want to sell.

There are a lot of products that you can’t use with an IRA. You also need to make sure they don’t store your money overseas, which is not allowed by the IRS for retirement vehicles like IRAs.

GoldBroker Custodian and Storage

Goldbroker has two primary partners with whom they work. In Europe, they use Rhenus Logistics. For IRAs in the United States they partner with Matterhorn Asset Management. They also have international storage options that are handled through Malca-Amit. Malca-Amit provides offshore storage in Zurich (Switzerland), Toronto (Canada), and Singapore (Asia).

It states that this is the best way to store your investments because it removes them from banking systems.

American IRA accounts can only purchase gold with GoldBroker using in-house storage provided at the company’s U.S. vaults found in New York. It comes with insurance through La Bâloise Insurance Company that is as good as what you would find elsewhere and is widely allocated across all precious metals, stocks, bonds, and other investments.

They believe outside of the banking system storage. This disposes of counterparty defaulting and bankruptcy risks, government confiscation, and bail-ins through the banking system. You are allowed to see and collect your gold in no more than 48 hours through this storage arrangement, regardless of whether banks are open or not.

The company has outside of the banking system storage, and this can eliminate any risks from counterparty defaulting or bankruptcy. Gold is always available for pickup in less than 48 hours, no matter what’s going on within the banks themselves.

Why Choose Goldbroker?

They provide physical gold and silver that you own. It is kept in a secure vault outside of the banking system. There are four vaults: Zurich (Switzerland), New York, Toronto, and Singapore.

Gold Mining Company and Investor Merchant Creek Mining Company recommends that you use Goldbroker when buying or selling your gold, silver, or other valuable metals. Goldbroker.com has an Excellent Rating with many systems online.

Fees

This company is different from its competitors in that it will not divulge the commission fees for its various bullion products. They claim these prices vary and get more expensive as customers purchase larger quantities of gold, silver, or platinum bars.

As their minimum order size is $10,000 for such products, it’s hard to say what percentages they are charging on average.

$75 is the approximate minimum commission total for their buy-back sales. They guarantee to buy back all precious metals that remain secured within their storage facilities and charge one percent, starting from the moment of purchase. Before you make a decision to buy, ask about these fees.

There are charges for storing things in the storage place. If your stored value is less than $20,000, you will pay 1.5% and a storage account maintenance fee of $110. The storage fees may be lower if you have more stored products with no need to pay the account maintenance fee.

Additionally, the vault may charge an additional $200 service fee associated with retrieving stored products or visiting.

Alternatives

American Hartford Gold

www.americanhartfordgold.com

Star Rating

The American Hartford Gold Group is pleased to help individuals and families protect their wealth by diversifying with precious metals. We offer three things: Precious Metals IRA, Gold IRA Rollover, Silver IRA Rollover & Physical Delivery of gold and silver bars and coins.

This company is in Los Angeles, CA, and helps people invest their money. This includes Gold, Silver, and Platinum. They sell them in bars and coins. The firm provides clients with physical delivery of gold to their house or into retirement accounts like an IRA, 401K, or TSP. This type of gold is safer because it’s not at risk from inflation.

Investors can buy gold and silver coins at a competitive price with 100% customer satisfaction guaranteed. At American Hartford Gold, we aim to educate and help clients about investments in the precious metal industry with complete transparency and fair dealing. They seek to provide all their customers with unparalleled customer service with trust and complete satisfaction.

They offer all of their clients a Buyback Commitment. They encourage the people to contact them first if they want to trade their metals. While they cannot guarantee that they will repurchase your metal, they never charge any extra fees if you want to sell. They also have a quick and simple 3-step process for you to complete the sale.

Goldco

www.goldco.com

Star Rating

Goldco helps customers protect their retirement savings by rolling over the cash they need to be saved in an IRA or other style of qualified retirement savings plan into a Gold & Silver IRA. A privately held firm, Goldco is rated A+ by the higher Business Bureau and encompasses a Triple-A rating from Business Consumer Alliance supporting positive customer reviews of our services, dependability, and business practices.

This company sells precious metals coins and bullion to collectors and investors. An experienced team of IRA specialists walks you through the method in a very way that’s simple. This way, you’ll be able to protect your retirement savings.

Conclusion

Goldbroker takes its clients’ safety very seriously. They operate with really good philosophies that offer every client full ownership of precious metals. They are interested in protecting you from all risks that are involved when working with intermediaries between yourself and your investments.

The company is a good service for people with a lot of money. However, there could also be other websites that offer better deals on gold; so before buying anything, do your research first!